Debt can become a trap that can seem to be impossible to get out of. It can seem like a hole that is too deep to climb out of. It can also seem like many of the debt help systems are not really there to help you. But what if there was an alternative? What if there was a way to consolidate your debt into an affordable repayment with a reasonable interest rate?

This may seem too good to be true, but for many South Africans who meet the criteria, they can take advantage of our debt help system. Our Bond Optimiser system has been designed to enable South African families to have financial stability. Less stress, less worry, more time planning and growing.

The debt help system often experienced is to put people under debt review and restrict their future chances of financial freedom. These customers are now restricted, often left with bad credit scores, and will struggle to get back on their feet. These customers also are often sold high-interest consolidation loans to help them, but in actual fact it makes their monthly budgets even tighter.

Instead of high interest debt, putting you under debt review and restricting your future; Bond Optimiser helps you to make affordable repayments and puts you through an education course that will help you to manage your money better in the future. Bond Optimiser has been shown to have improved our clients credit scores by 20% on average.

Using our system, you can avoid cashing out those pensions you have worked so hard to build up. Work with our team to build longevity and stability in your financial life. We will help you build a strong payment history to ensure your credit score increases.

Our team at Bond Optimiser will also help you to reduce your monthly payments and get onto a better debt plan. Here are some of the steps that you will be assisted with:

Create A Budget

Working out what you earn, what you owe and what you need to spend to survive are very important. Putting these into a monthly budget can help you to manage your finances in a better way. It allows you to step back and see the big picture of what is happening with your money.

Creating a budget also allows you to see areas you could cut back or areas you may be wasting money. This can in turn help you save money every month giving you the power to use the money how you see fit. The Power is back in your hands!

Set Up A Debt Payment Plan

Now that you have drawn up your budget, you will be able to see what you can afford. You can look at your debt and work out the best way to tackle this.

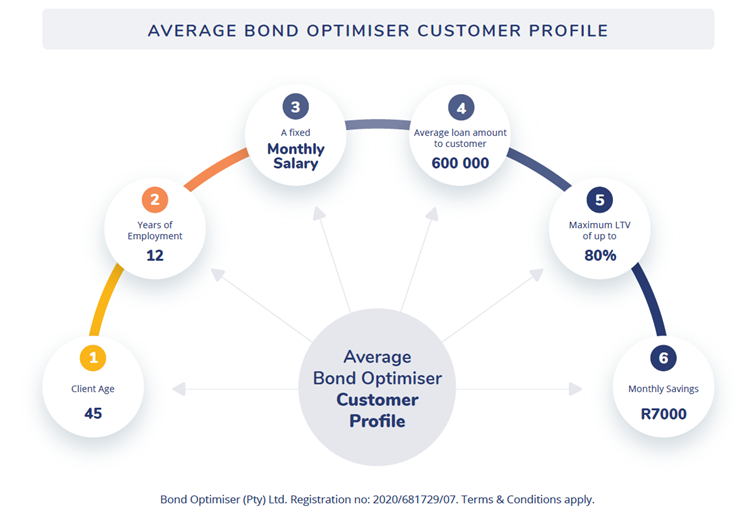

By using your property, our team can work with you to restructure your debt into one affordable and sustainable monthly payment. Statistics have shown that our average customer can save up to R7000 per month.

Lowering Your Interest Rates

By using your bond value and considering your high interest debt into your bond, you can massively reduce your interest. This is a key feature of the Bond Optimiser system as this can help make your monthly debt repayments more affordable.

Lowering Your Debt-to-Income Ratio

Reducing your debt while remaining at the same level of income can help you to have a lower debt to income ratio. Lowering this ratio can help lift the weight and burden you feel allowing you to be free! All we want is for you to be and feel free.

Reduce Future Unsecured Debt

By going through the Bond Optimiser’s in-house financial literacy course, you will be able to learn how to manage your money better. This system will help you to switch out to a traditional mortgage lender after the program. After taking the course, we have found our customers to make better financial decisions and be more financially aware.

The result is less unsecured debt in the future.

While many people have had bad experiences with debt help systems, it does not mean that they are all bad. Bond Optimiser has been designed to help you, not restrict you. We want you to have a full and free life, not one that is burdened or restricted due to a bad credit profile. Our team will offer you the best service when you need it most.

Speak to a consultant today to see if Bond Optimiser can help you!

It is Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd’s policy to respect your privacy regarding any information we may collect while operating our website. This Privacy Policy applies to www.bondoptimiser.co.za (hereinafter, “us”, “we”, or “www.bondoptimiser.co.za”). We respect your privacy and are committed to protecting personally identifiable information you may provide us through the Website and any of our Social Media Platforms. We have adopted this privacy policy (“Privacy Policy”) to explain what information may be collected on our Website and any of our Social Media Platforms, how we use this information, and under what circumstances we may disclose the information to third parties. This Privacy Policy applies only to information we collect through the Website and any of our Social Media Platforms and does not apply to our collection of information from other sources.

This Privacy Policy, together with the Terms and conditions posted on our Website, set forth the general rules and policies governing your use of our Website and any of our Social Media Platforms. Depending on your activities when visiting our Website and any of our Social Media Platforms, you may be required to agree to additional terms and conditions.

Website Visitors

Like most website operators, Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd collects non-personally-identifying information of the sort that web browsers and servers typically make available, such as the browser type, language preference, referring site, and the date and time of each visitor request. Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd’s purpose in collecting non-personally identifying information is to better understand how Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd’s visitors use its website. From time to time, Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd may release non-personally-identifying information in the aggregate, e.g., by publishing a report on trends in the usage of its website.

Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd also collects potentially personally-identifying information like Internet Protocol (IP) addresses for logged in users and for users leaving comments on https://bondoptimiser.co.za blog posts. Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd only discloses logged in user and commenter IP addresses under the same circumstances that it uses and discloses personally-identifying information as described below.

Social Media & Advertising

When you choose to share your personal information with Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd’s official social media accounts by submitting your information such as your name, your email address and your contact number to a social media form, you are giving Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd consent to contact you about Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd’s service and product offerings.

WhatsApp & Advertising

When you choose to share your personal information with Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd’s official social media accounts by submitting your information such as your name, your email address and your contact number to a social media form, you are giving Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd consent to contact you about Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd’s service and product offerings.

Gathering of Personally-Identifying Information

Certain visitors to Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd’s websites choose to interact with Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd in ways that require Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd to gather personally-identifying information. The amount and type of information that Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd gathers depends on the nature of the interaction. For example, we ask visitors who sign up for a blog at https://bondoptimiser.co.za to provide a username and email address.

Security

The security of your Personal Information is important to us, but remember that no method of transmission over the Internet, or method of electronic storage is 100% secure. While we strive to use commercially acceptable means to protect your Personal Information, we cannot guarantee its absolute security.

Advertisements

Ads appearing on our website may be delivered to users by advertising partners, who may set cookies. These cookies allow the ad server to recognize your computer each time they send you an online advertisement to compile information about you or others who use your computer. This information allows ad networks to, among other things, deliver targeted advertisements that they believe will be of most interest to you. This Privacy Policy covers the use of cookies by Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd and does not cover the use of cookies by any advertisers.

Links To External Sites

Our Service may contain links to external sites that are not operated by us. If you click on a third party link, you will be directed to that third party’s site. We strongly advise you to review the Privacy Policy and terms and conditions of every site you visit.

We have no control over, and assume no responsibility for the content, privacy policies or practices of any third party sites, products or services.

Aggregated Statistics

Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd may collect statistics about the behavior of visitors to its website. Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd may display this information publicly or provide it to others. However, Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd does not disclose your personally-identifying information.

Affiliate Disclosure

This site uses affiliate links and does earn a commission from certain links. This does not affect your purchases or the price you may pay.

Cookies

To enrich and perfect your online experience, Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd uses “Cookies”, similar technologies and services provided by others to display personalized content, appropriate advertising and store your preferences on your computer.

A cookie is a string of information that a website stores on a visitor’s computer, and that the visitor’s browser provides to the website each time the visitor returns. Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd uses cookies to help Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd identify and track visitors, their usage of https://bondoptimiser.co.za, and their website access preferences. Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd visitors who do not wish to have cookies placed on their computers should set their browsers to refuse cookies before using Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd’s websites, with the drawback that certain features of Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd’s websites may not function properly without the aid of cookies.

By continuing to navigate our website without changing your cookie settings, you hereby acknowledge and agree to Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd’s use of cookies.

Privacy Policy Changes

Although most changes are likely to be minor, Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd may change its Privacy Policy from time to time, and in Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd’s sole discretion. Bond Optimiser (PTY) LTD & Africa Direct Edubond (Pty) Ltd encourages visitors to frequently check this page for any changes to its Privacy Policy. Your continued use of this site after any change in this Privacy Policy will constitute your acceptance of such change.