5 Personal Finance Tips Every South African Should Know

Personal finance is the entire financial world that makes your financial life. Each individual has their own set of needs, wants, desires and goals; hence the personal in personal finance. While we may understand what the word means, many of us find personal finance to be confusing.

Here are five Personal Finance tips that are easy to implement and can hopefully make your financial life a little easier.

5 Personal Finance Tips

Set a Budget And Stick to It!

Setting a budget and sticking to it is a crucial part of your financial life. Knowing where your money is coming from, where your money is going and what bills you have to pay; is a crucial part of managing your finances. Use your bank statements along with a budget diary to record your money movement. Read more on budgeting in our Budgeting Article.

Consolidate Your Debt into Your Home Mortgage

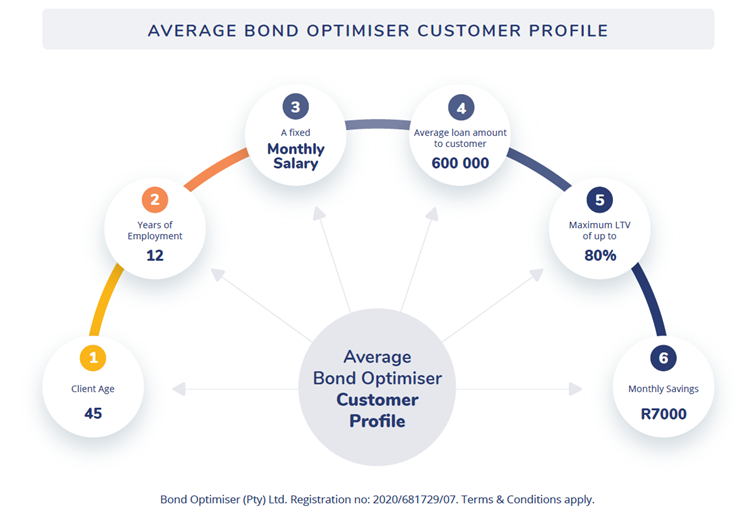

Debt can be overwhelming, especially when you have multiple accounts to pay to numerous creditors. It can seem like an impossible task to pay off this high interest debt. Rather than feeling like you are caught in a debt trap, talk to our Bond Optimiser Team. Our team has helped many clients save up to R7000 a month in debt repayments by consolidating their debt into their home mortgage. Speak to our team to learn more or read about our debt help system.

Build an Emergency Fund to Cover Unforeseen Expenses

Life is unpredictable. Accidents happen, cars break down, unexpected and unforeseen expenses occur. In these situations, it is helpful to have an emergency fund of savings that is easily accessible to cover these unexpected expenses, rather than relying on debt or credit facilities. Start building up an emergency fund to give yourself peace of mind to handle life’s unpredictability.

Automate Your Finances to Remain Consistent

Setting up autopayments and auto transfers can help save you time. By setting up autopayments on your credit cards, loan accounts and mortgages, you can save the time you usually spend reading statements and making payments. Auto transfers are also a great way to consistently grow your savings by setting up an auto transfer to your savings account.

Negotiate Your Salary

We often speak about saving money, but what about earning more money? By working with your employer to upskill yourself, take on more responsibility and negotiate a higher salary, you can increase your earnings tremendously. The key is to ask your employer how you can become more valuable to the company and then to achieve those targets.

Personal finance does not have to be a confusing world. The best way to get better at managing your personal finances is to learn. This is what led us to create an inhouse financial literacy course called Edvance to help our clients achieve knowledge and freedom. This foundational financial course covers all the fundamentals to help our clients achieve their financial goals.